Many of you know I served as a teacher, college counselor, and director of alumni prior to becoming a financial advisor. Deciding to become an educator was an easy decision for me. Simply put, I wanted to help students like me. There was so much I had learned that I wish I would have known or I wish my parents would have known. I am a first-generation college graduate and I still cringe thinking about my first year of college — leaving home, the guilt, the lack of resources, feeling under-prepared, etc..

Not only was becoming a teacher in alignment with my passion, it was in alignment with my mission to provide first-generation students access to resources so that maybe their experience would be that much easier – or at least they feel more prepared. We both know there is no substitute for being a first-generation college student but having access to resources and someone to call upon is something others whose parents did go to college often have.

I wrote this post in a similar spirit. I must believe that if more students and families understood the benefits of saving for college rather than borrowing, they would develop a plan to do so. As I share below, we didn’t have a plan when it came to paying for college – it was “Si Dios quiere” or “God Willing.” No disrespect, but that is not a plan.

I think I’ve told you that I used to share with my students (when I was a teacher and a counselor) that my mom must have had a PhD in being a mom. The one thing I do remember about college from an early age is that college wasn’t an option! My brother and I were going to college. In a recent blog I wrote that “Both my parents worked full time to send us to a parochial school we couldn’t really afford.“ My parents sacrificed a lot to send my brother and I to a parochial school because they believed that we would be better prepared for college. To them, this was their investment in my future.

In the absence of their education, my parents leaned on our teachers and our school to help us get to college.

My mom and dad didn’t know what a college savings plan was. Even if they did, they were already living well beyond their means. They would have had to make some changes to their lifestyle and develop a plan in order to account for some extra funds going toward planning for our future. I know many of you can attest to the fact that that is a hard thing to do. Once you start making money and grow accustomed to your paycheck, it is hard to figure out how you used to live on any less. That is called lifestyle creep. As we earn more money, our lifestyle evolves along with it.

Our plan was simple: Work hard in and out of school in hopes of earning a scholarship. And the rest was out of our hands. Si Dios quiere, as we used to say. If it is His will, then we will figure out a way to get to college. Come to think of it, we depended on Him for a lot. Although it happened to work out fine, it was not a real plan. I could have struggled in school academically and not been admissible to schools like Notre Dame. OR I could have been undocumented, as several of my students are, and not eligible for federal aid. I don’t think I really understood what financial aid entailed until I had to apply for it my senior year of high school. My parents knew less about it than I did.

A goal without a plan is just a wish.

When I served as a teacher and college counselor, it was evident that my family was not alone in how we thought about our “plan.” Many of my students and their families did not have a plan for how they would pay for college either. For some, like me, the plan worked out fine. They received financial aid and scholarships that made their college pursuits a possibility. Others took on an overwhelming amount of debt or were forced to work more hours than they spent in school, eventually causing them to attend part-time or stop going altogether. When I used to ask my college students what the biggest obstacle was to them completing their degree, their response was overwhelmingly “money”.

MONEY CAN BE FOUND

I truly believe that. For any goal, not just college you can find money within your budget. The thing is, you need a plan. It will not just happen. Most of us think about saving last. We save based on what we have left at the end of each month. I believe that our goals are too important and deserve a higher priority. This is where the idea of “Pay Yourself First” comes from. When it comes to college especially, we may be overwhelmed by the cost that perhaps it causes us to take no action.

A college education offers a lifetime of expanded knowledge, friendships, interests — and can help make dreams become a reality. The rising cost of higher learning can put these dreams in jeopardy.

That’s where a 529 college savings plan can help! Designed to help families meet higher-education expenses for any accredited post-secondary school in the nation, 529 college savings plans offer a convenient, flexible and tax-efficient way to save for higher learning.

BASICS OF A 529: SAVING NOW VS. BORROWING LATER

If you’re thinking of funding your child’s higher education by borrowing, you may want to think again.

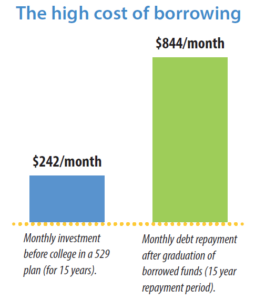

Borrowing could cost you twice as much as saving in a 529 college savings plan, as this chart illustrates. If you begin depositing $242 per month when your child is three years old and continue these monthly investments for 15 years, could have saved more than $100,000 when the first class bell rings: $43,560 in principal investment and the remainder in earnings on that principal, based on a 10 percent rate of return.

If, instead, you choose to borrow $100,000 at 6 percent interest to pay for your child’s four years at college, you — or your child — could face payments of $844 per month for 15 years after graduation. The total cost to you of the “borrowed” degree is $151,920. The difference between the total cost to you of the two degrees? $108,360 — enough to possibly fund a second college education.

Let’s schedule a time to talk: I’d be happy to share more and answer your questions.

Participation in a 529 College Savings Plan (529 Plan) does not guarantee that contributions and investment return on contributions, if any, will be adequate to cover future tuition and other education expenses or that a beneficiary will be admitted to or permitted to continue to attend an educational institution. Contributors to the program assume all investment risk, including potential loss of principal and liability for penalties such as those levied for non-educational withdrawals.

An investor should consider, before investing, whether the investor’s or designated beneficiary’s home state offers any favorable state tax treatment or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in such state’s qualified tuition program. Consult with your financial, tax or other adviser to learn more about how state-based benefits (including any limitations) would apply to your specific circumstances. You may also wish to contact your home state or any other 529 college savings plan to learn more about the features, benefits and limitations of that state’s 529 college savings plan. Furthermore, the Tax Cuts and Jobs Act that was signed into law on December 22, 2017 allows for up to $10,000 a year per beneficiary in tax free distributions from a 529 Plan if used for tuition incurred for enrollment or attendance at a public, private, or religious elementary or secondary school. Check with your state’s guidelines prior to withdrawing the funds.

For more complete information, including a description of fees, expenses and risks, see the offering statement or program description.

Tax services are not offered through, or supervised by Dearborn & Creggs Investments.