I became a financial advisor for the same reason I became a teacher — to help transform communities.

HOW MUCH SHOULD I BE SAVING IN A RETIREMENT ACCOUNT?

-

Start early OR start today. If you’re just starting out your career, now is the time to begin building the financial habits that will allow you to take advantage of time — you have many working years ahead. When I started my career as a teacher, a mentor of mine shared the importance of contributing to a retirement account — 10 years later, I am increasingly appreciative of that advice. For those of you playing a bit of catch-up, start today — your future self with thank you. For those age 50 or older, you are eligible to make “catch-up contributions” as well.

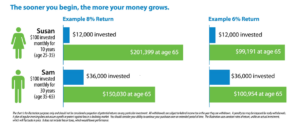

If you’re not yet adulting, let me help. Maybe you’re a working professional but still living with your parents. If your financial commitments are limited to yourself — no spouse, mortgage, children, etc. — right now may be the perfect time to front-load your savings. Your life (and finances) could look very different in 10 years. Below is an illustration that highlights the importance of starting early and the power of compounding — you can also check out a video here.

-

Set a goal to save 15% of your income. It’s not about how you start, but how you finish — first, you need to start. Maybe today you start with 5% and increase each year. It is the contribution rate that is going to drive your retirement success. If you’re not saving enough, the best investment is not going to help create the retirement that you envision. If you’re able to contribute a percent (%) rather than a flat dollar amount, do so. As you earn more, your contributions will automatically increase.

Example: If you earn a $55,000 salary and get paid 26x per year ($55,000/26), your pay before taxes is about $2,115. Therefore, a 5% contribution = $105, 10% = $211, 15% = $317.

The number-one factor in determining how much you’ll have at retirement is the amount you save throughout your career.

- Take advantage of your company match. If your employer offers to match your contributions, you should be contributing at least to the amount they will match. This is free money! If they match up to 5%, you should be contributing at least 5%. Otherwise, you risk leaving money on the table that would have been given to you otherwise.

-

Make it automatic. We are emotional human beings — if left to our own devices, we often choose to save last, if we have enough money left over each month. “Pay yourself first” is a mindset that puts YOU first. Take the emotion out of the decision and put your retirement saving at the top of what you have to pay each month. If your employer offers an option to increase your contribution automatically each year, take advantage of it! Otherwise, set a reminder or work with your advisor to serve as your accountability partner.

My values drive my decisions

LET’S MAKE A PLAN!

Schedule a Meeting: In person or virtual