When it rains, it pours.

You’ve heard the expression. Growing up, I heard my family say this time and again — mostly when we found ourselves in some sort of financial pickle. Whether it be the dog getting sick, the car breaking down or needing a new air conditioner in the house. There were less dire situations, however, that also put a strain on our finances — paying for prom, paying registration fees for sports or other school clubs, etc… These times were hard because they seemed to sneak up on us out of nowhere. They were unexpected expenses, and therefore, likely caused us to resort to borrowed money — credit cards, payday loans, friends and family. If you’ve experienced this as a child or adult, you may understand that exhausting feeling.

The reality is, most people hope and pray that emergencies will never happen and therefore do not plan for them. In many cases, those emergencies will also impact your finances if you are not prepared. But what if you could predict the future? I’ll let you in on a little secret — every so often, and probably throughout your life, you will experience an emergency. Does each one need to feel like an emergency?

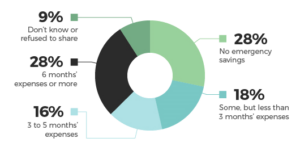

When I began earning a paycheck, my first financial advisor (professor from college) told me that one of the highest priorities when it comes to my personal finances is to build up my cash reserve. Generally, it is recommended that you aim to save 3-6 months worth of expenses. Depending on where you are in your life and career, that may feel like an unreasonable goal today. No worries — the important thing is that you set a goal to start with — say $1,000 — and make a plan to increase that automatically over time in an effort to reach your goal. Here’s a look at how Americans are doing when it comes to emergency savings.

If you do not have an emergency savings, you’re not alone. I will say, however, it is an important component to everyone’s financial plan. With that said, I’d like to a few reason having an emergency fund is important to you.

NOTE: An emergency fund is not meant to replace traditional forms of insurance that would protect you in the case of a serious event. That is what insurance is for.

WHY SHOULD I HAVE AN EMERGENCY FUND?

-

Less stress. This is the best reason, in my mind. If I know emergencies will happen, I don’t have to fret the next unexpected cost if I have an emergency fund. I honestly sleep better at night knowing that I’m not one emergency away from being in the negative.

- It is a form of self-insurance. I intentionally have higher deductibles on my car and health insurance. First of all, higher deductibles mean lower premiums. Additionally, having an emergency fund allows me to feel okay about this as I know if something reasonably small happens to my car, for example, I could pay for it without having to file a claim (and causing my premiums to increase). My windshield just cracked on my car last week. I’m blaming the Texas heat. I’d consider that “emergency fund” worthy. I could either pay my deductible and file a claim on my insurance, causing my premiums to increase OR just pay to replace my windshield. I am using my emergency fund to replace my windshield.

- Prevents you from taking on more debt. I cry a little when I hear people say, “I have a credit card but I only use if for emergencies.” You and I both know that Chick-fil-a is NOT an emergency. And unfortunately, when you don’t have money in the bank, everything qualifies as a reason to use your credit card, even food. The tough reality is that by borrowing rather than saving for these situations, you end up paying much more. The cost of borrowing is known as interest. When we’re not prepared, we often resort to other places for funds — credit cards, and retirement accounts. As you may know, carrying a balance on your credit card can be detrimental to your finances given their high interest rates. By withdrawing funds or borrowing from your retirement accounts, not only may you be subject to an early withdrawal penalty, you are missing out on the time those funds could have remained invested and the potential growth in your account.

- Affords you the opportunity to save (more) money. Once you have your emergency account funded, you may be able to take advantage of some additional savings opportunities. You will have the freedom to be more intentional about other financial goals you have — maybe you would like to travel more, save for your dream car or save more for retirement.

TAKE ACTION

If you don’t already have one, open a new savings account through your current bank or maybe even an online bank and name it Emergency Fund. Do not depend on yourself to transfer what you have left at the end of each month into your savings account. You will want to schedule automatic deposits into this account on a regular basis — maybe the day after each pay day or on a monthly basis. You shouldn’t have to think about it. Start with an amount that feels right to you and increase it on a regular basis as you learn more about what your finances look like month-to-month.

Oftentimes, the most difficult part is getting started. By doing so, you’ll be ahead of 28% of Americans who have no Emergency Fund at all.

LET’S MAKE A PLAN!

I know that you’re busy and it’s not always easy to make sense of your personal finances. There is no substitute for having a plan. Whether you’re just starting out or interested in learning more, I am happy to be a resource along the way.

Jesse is a graduate of the University of Notre Dame and earned his Master’s in Education from Harvard. In his education career, he served as a teacher, counselor and Director of Alumni for YES Prep Public Schools. He is a member of the Teacher Retirement System of Texas (TRS) and takes pride in helping fellow educators better understand their pension and plan for their future. Learn more about Jesse.