You’ve heard it before (adulting) and if you’re a part of my generation, it’s likely about to or already has hit you like a brick wall.

Not everybody needs life insurance but chances are, you do.

Nothing can prepare you for the loss of a loved one, much less the loss of your parent or guardian. I was fortunate enough to grow up with both of my parents. And although we did not do without financial issues, both my parents worked and were involved in our lives. They made an effort to keep up with our soccer, football, basketball, cross country, track, etc. practices, games and meets. On top of that, they rarely flinched at the chore of driving us around on the weekends to meet up with friends. For many of us, these are experiences we take for granted. No matter how many hours I put in as a teacher or how many school and sporting events I attended in support of my students, the loss of a parent or guardian cannot be replaced.

Last month, I had the honor of serving as a Screener for the Life Lessons Scholarship.

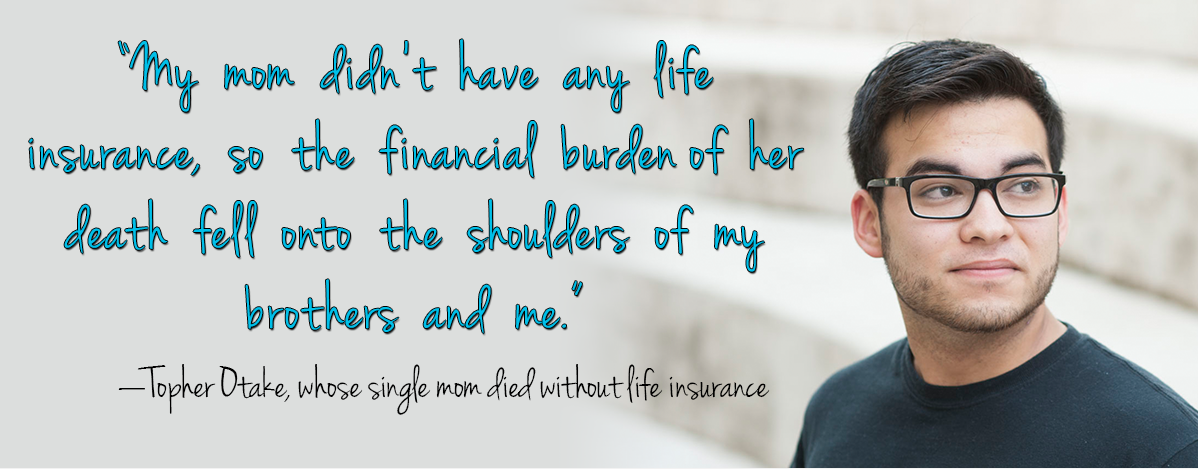

I read the applications of 36 incredible and deserving students from across the country, all of whom have been affected by the loss of a parent or guardian and many of whom have had to put their education on hold because of it.

A college education is already a major financial challenge for most families. But it becomes infinitely more difficult for a student when a parent dies, leaving little or no life insurance.

When you read about the obstacles these students have had to endure, you wonder why one wouldn’t have life insurance. I understand that it is not that simple, but maybe it should be. In last month’s blog post, I wrote Your cell phone bill is standing between you and your goals. Maybe it is a matter of re-prioritizing. Call it your cell phone bill, cable package, eating out, etc. – there is always a way to find some extra money for the things that are really important. Trust me, my mom made it happen all the time when I was growing up.

If you think you need life insurance but don’t have it, you’re not alone. Start here:

- Calculate your need. Everyone’s needs and goals are different. Use this free calculator from Life Happens (www.lifehappens.org/howmuch)

- Reach out to me for a quote. As an independent financial advisor, I have the ability to shop quotes from many different companies, not just one.

I’m too ________ for life insurance.

… Cool? Healthy? Young? Broke? Busy?

The great mystery of life is the length of it. We all hope to live a long, healthy life — we cannot predict the future, however. And the reality is that life insurance is something you never use until you actually need it — and we hope we’ll NEVER have to use it. BUT our lives can change in an instant. You could have all your finances in order — you’ve saved for an emergency, you have invested for your retirement and even put away some money each month for your Little’s education — but you didn’t protect yourself from the unexpected. The first step in strengthening your family’s financial future is to face some worst-case scenarios.

I get it — life is busy. But if you were to put first things first, this should likely top your list. Here are some quick stats from www.LifeHappens.org.

- It’s too expensive. Those with no life insurance think it is 3X more expensive than it actually is.

- I don’t have time. A third of people haven’t bought life insurance or more of it because they “haven’t gotten around to it.”

- Out of sight, out of mind. A third of people aren’t buying life insurance because they “don’t like thinking about death.”

Life insurance isn’t for the people who die. It’s for the people who live.

SO, ARE YOU A D U L T I N G ?

LifeHappens.org Life Insurance brochure.

Let’s Connect!

Schedule a time for you and I to speak more about your personal finances. We can do so online, over the phone or in-person.