IF I KNEW THEN WHAT I KNOW NOW…

-

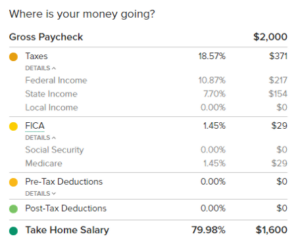

This was the first time I was going to be making a real salary and it was a lot of money for me considering what my parents earned.

- We work hard and deserve to “treat yo’ self!”

- You might feel internal pressure or pressure from your family to be “better off” than they were.

Ten years ago, someone took the time to teach me some basic personal finance concepts that have made a difference in the way I view my money and how I set goals. It started with me as a first year teacher. I didn’t know what I was doing in my job, much less my finances! I committed to learning a little bit at a time and I had someone hold me accountable to the goals I set. We teach our children and students that by building strong habits early, they are likely to become a part of how we operate. The same can be said for bad habits, too! If you’re a veteran teacher or a non-educator looking for a reset when it comes to your personal finances, there is something here for you as well.

PERSONAL FINANCE HACKS FOR 1ST AND 2ND YEAR TEACHERS

Instead of saving what you don’t spend, spend what you don’t save.

3. Set your expectations and be realistic. I believe you can have anything you want, you just can’t have it all at once and you need to plan for it. Spend on what you love and cut back ruthlessly on what you don’t. Your fixed monthly expenses shouldn’t exceed 50-60% of your take-home pay. Yes, that even includes your student debt payback. If you’re not there today, aim to get there.

4. Pay yourself first. Today, most Americans have less than $1,000 saved for retirement and 50% have nothing saved (Economic Policy Institute, 2016). Rather than saving what you don’t spend, spend what you don’t save. This was a huge mindset shift for me and vastly different from what I knew about how people save. Get in the habit of saving money now, before you get accustomed to your take-home pay. Aim to save between 10-15%. You will likely find that you will figure out how to make it to the end of the month with what you have left. Make some adjustments as needed. The important thing is to start.

5. Find a roommate. This is one of the smartest things I did as a young teacher. I get it, you’re grown and are ready to live on your own. That said, being a teacher is hard work. Having someone to vent and celebrate with was just good for my mental health. Being able to split ALL expenses was also a plus. Even if you just do it for a couple of years, your future self will thank you.

6. Use your current car or buy used.This is likely one of the more difficult financial decisions for people. And I don’t blame them, I love cars. I’m also not here to judge you on what to value. We often dream about what car we’ll get when we start earning our first paycheck. BUT, many recent college graduates go out and lock a good portion of their paycheck into a car payment for 5 years, if not longer. If you already have reliable transportation, use those funds to start a rainy day fund for when you need new tires or a tune-up — because you will (see my blog on emergency funds). Don’t get me wrong, I want a Tesla. I just don’t need one today.

7. Shop around to lower your monthly bills. You can shave a significant portion off your monthly expenses if you’re willing to do some research. Look into your car & renter’s insurance, cell phone, electricity, cable bills, etc… I save money in these areas by streaming rather than having cable, by utilizing a less expensive cell phone provider, for example.

9. Find your side-hustle. If you’re a 10 month-employee, you have a unique opportunity to earn a little extra during the summer. Summer school is the obvious one. But maybe you just need a break from the classroom — if so, get creative. Uber, Etsy, etc..

10. Teacher discounts! Classroom materials aside, teachers can get discounts on technology, clothing, furniture, travel, etc…Take some time to substitute your discount for items that you traditionally pay full price for. Be sure to keep your Teacher ID handy,

LET’S MAKE A PLAN!

Jesse is a graduate of the University of Notre Dame and earned his Master’s in Education from Harvard. In his education career, he served as a teacher, counselor and Director of Alumni for YES Prep Public Schools. He is a member of the Teacher Retirement System of Texas (TRS) and takes pride in helping fellow educators better understand their pension and plan for their future. Learn more about Jesse.