ENOUGH! I’M READY TO TAKE CONTROL OF MY FINANCES. THE 50/30/20 RULE

Before you read anything else, you should know that I operate in a no judgement zone about your personal finances. I know how difficult it can be to ask for help. I entered this profession to help others by sharing what I know. If you are willing to share, I am here to listen. If you are committed to improve, I am here to help.

I am and will forever be grateful to my parents for all they have provided me and more. They loved me unconditionally, attended most, if not all, of my sporting events growing up, I always had a roof over my head and hot food on the table, we had transportation, and they sacrificed to ensure my brother and I received a good education in El Paso. On the surface, it may have seemed as though we had it together as a family and even in our finances.

Truth be told — my family was no stranger to the “paycheck to paycheck” life. But why? Both my parents had steady jobs in El Paso as I grew up. Neither of them had a college degree but they both worked in an office from 8-5 for much of their careers, earned a living salary, had access to generous benefits, PTO, etc. Our basic needs were always met as were many of our wants. My parents aren’t much different than most Americans when it comes to their personal fiances. Regardless of income, most American’s have less than $1,000 in savings, meaning one emergency could have a significant impact on their personal finances. If you’ve been there, you can understand the stress that comes with that vulnerability. I knew early on that I wanted to learn to do things differently.

Being in control of your money doesn’t have to mean being cheap

I admit, when I first became interested in personal finance, I was right out grad school and I purchased a book called The Ultimate Cheapskate. It was an interesting read and I learned a lot, but I quickly learned that it was unsustainable, especially for a 20 something living in this great city of Houston! I can understand how it works for some, but not most. I’d like to think that my mindset around money has matured since then. Now, I try to live by the idea, “Spend money on the things you love and cut back relentlessly everywhere else.” Unfortunately, most of us spend blindly, oftentimes on things we don’t even value that much.

OLD SCHOOL AND NEW SCHOOL BUDGETING

Most of us budget by creating a spreadsheet that includes all of our expenses; we promise ourselves that we’ll spend less and save more next month. When we don’t, we get discouraged and don’t open the spreadsheet again until next year. This method could work but requires a level of discipline that is exhausting for most. This is part of the reason most New Year’s resolutions don’t stick — we often set goals that are too big or too broad. When we don’t see immediate results (health/weight, career, finances, etc.), we get discouraged and lose steam.

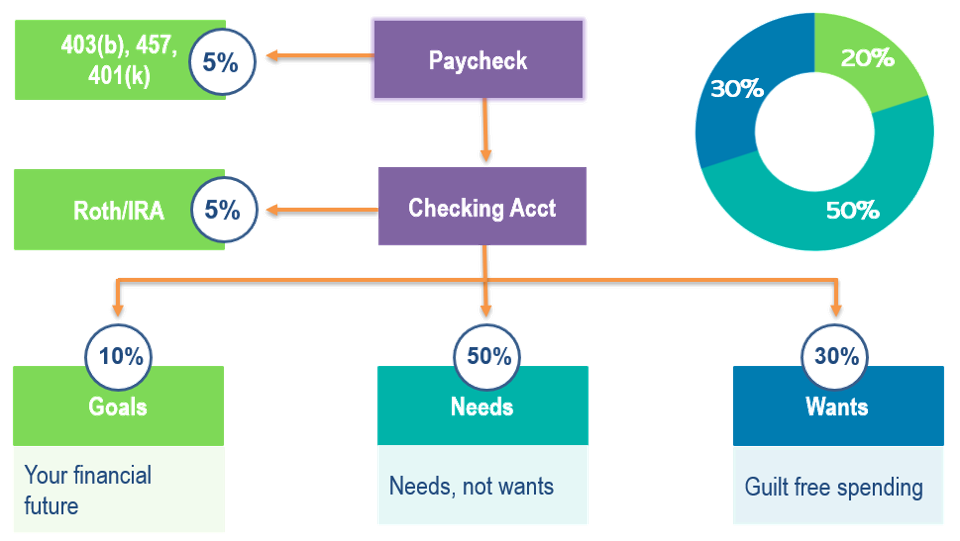

So, I’d like to propose a different way of thinking about your budget. Rather than trying to fit your spending into line items on a spreadsheet or line items that often include the “miscellaneous” category, I propose you categorize into three buckets. I cannot take the credit for this approach. In their 2005 book, Elizabeth Warren and daughter Amelia Warren Tyagi coined the 50/30/20 Rule for spending and saving. It provides a simple framework to start with. This is the approach I take when working with clients. It is just one way to think about your finances, however, I find that it provides a structure that many crave.

ENTER THE 20/50/30/ RULE

This is a framework so if you need to adjust your percentages to start out, please do so. But EVERYTHING needs to fit within 100%. I’ll repeat that for emphasis. All your expenses need to fit within 100% of your income. If you spend more than you make, you will find yourself in a place that is even more difficult to come back from. Remember, this is about taking control of your finances and your future. It will require thinking differently. But consider the possibility of saving 20% of your income and what that could do for your future!

Spend money on the things you love and cut back relentlessly everywhere else.

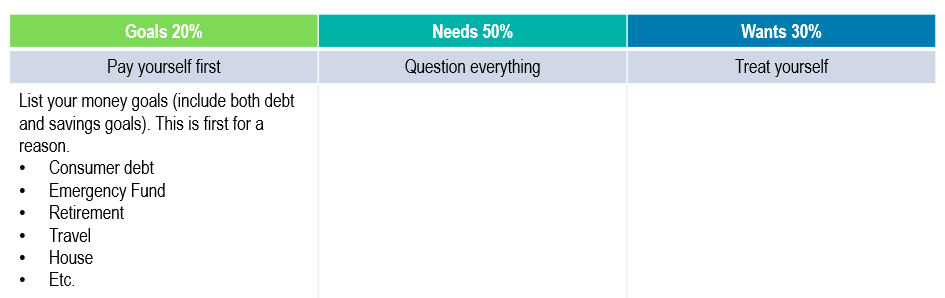

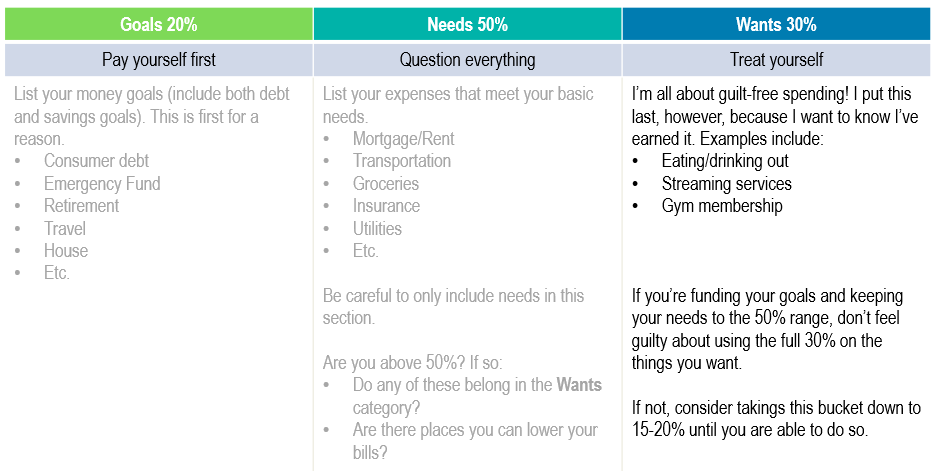

20: GOALS: SAVINGS & DEBT | PAY YOURSELF FIRST

Most Americans have less than $1,000 saved! Why? For many of us, it is how we think about our money. We wait until the end of the month to see what’s left before we even think about saving. Once we decide if we have anything left, it takes action on our part to put that money into a savings account. And we do that (or don’t) month after month. Ugh! That sounds awful. But what if it didn’t have to be? Set up a plan to automatically put 20% of your take-home pay toward your retirement, savings and debt. Notice that you command a piece of your budget (20%) go toward savings and debt before your needs (50%) and wants (30%). Your goals should take priority here if you are committed to taking control. Pay yourself first.

- 10%: retirement accounts (401k, 403b, 457, IRA)

- 10%: debt and savings goals. For debt, this would be money in addition to your required minimum payment. For example, if you’re working on paying a credit card and it has a $25 minimum payment, I’d suggest putting that bill in the Needs category and anything extra in the Goals category. For Savings, this is where your savings goals below — emergency savings, travel fund, new car fund, wedding fund, house fund, name your goal fund, etc..

Again, don’t hesitate to adjust the percentages to meet your needs. If you have high debt, for example, that may take priority.

30: WANTS | TREAT YOURSELF

I want to eat out occasionally, I want to meet friends for coffee or drinks, I want new clothes every now and again… And you should be able to do it all — remember, spend on the things you love and cut back relentlessly everywhere else. This section is last for a reason. Too often, we start here and don’t have anything left for our goals. Depending on how your numbers are shaping up for your Goals and Needs sections, you may need to have a conversation with yourself about areas you can cut back, even if temporarily because your goals are THAT important to you.

If your needs are taking 65% of your monthly income, for example, you now have 15% left for wants. If you put a plan in place, this will only be temporary! Remind yourself that we are putting in the work for the long-term. The stronger habits we can develop now, the better of we’ll be in the future.

Hard choices, easy life. Easy choices, hard life.

I get pretty excited when I think about the freedom to spend 30% of my income on the things I enjoy each month. This prevents me from taking the joy out of my money, making my goals unsustainable. You work hard and you deserve to treat yourself! I think that 30% is a generous amount so depending on what you find your expenses come out to be in your NEEDS category, you may need to adjust. The more honest you are about where an expense belongs, the more consistent you will be over time.

By failing to prepare, you are preparing to fail. – Benjamin Franklin

I get it — life isn’t always so clear cut, right? Things come up, emergencies happen — life is unpredictable. But what if you could predict the future? I’ll let you in on a little secret — every so often, and probably throughout your life, you will experience an emergency. Does each one need to feel like an emergency? The more you plan for the unexpected, the less likely “an emergency” (i.e. my car was towed, I needed new tires, my phone broke, etc..) is to derail your goals.

There you have it — the 20/50/30 rule. I always start with 20 — pay yourself first. I’d be happy to walk through this with you utilizing your numbers. I am committed to helping my clients get in to the positive with their expenses rather than living in the negative. We all start somewhere — maybe this is where you start.

LET’S MAKE A PLAN!

I know that you’re busy and it’s not always easy to make sense of your personal finances. There is no substitute for having a plan. Whether you’re just starting out or interested in learning more, I am happy to be a resource along the way.

Schedule a Meeting: In person or virtual

Jesse is a graduate of the University of Notre Dame and earned his Master’s in Education from Harvard. In his education career, he served as a teacher, counselor and Director of Alumni for YES Prep Public Schools. He is a member of the Teacher Retirement System of Texas (TRS) and takes pride in helping fellow educators better understand their pension and plan for their future. Learn more about Jesse.