The power of compounding is the single most important reason to start investing now.

YOUR TRS PENSION IS JUST ONE PIECE OF THE PIE

-

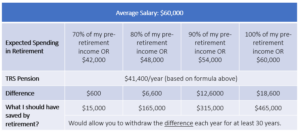

Average Highest Salary: $60,000

-

Years of Service in a TRS position: 30 years

Regardless of where you are in your career, this is great information to have, because it gives you a starting point. Will that be enough for you? That depends on you and your expenses, mostly. The current consensus is that you will need between 70-90% of your pre-retirement income in retirement. Although it may be easy to assume that you will spend less in retirement, about half of retirees end up spending more, according to the Employee Benefit Research Institute (EBRI).

YOU WILL NEED ADDITIONAL SAVINGS — HOW MUCH, DEPENDS

OTHER WAYS TO MEET YOUR GOAL

-

Increase your salary (and not your expenses): Remember, your TRS pension is based on your highest 3 or 5 years of salary. As we saw above, 69% of $60,000 is $41,400 but 69% of $80,000 or $100,000 would make a big difference for your retirement income as well.

-

Work longer: Every year more that you work, your pension eligibility goes up by 2.3%. In the example, I used 30 years, which when multiplied by 2.3% is 69%. 35 years x 2.3% is 80.5%.

-

Save more: Maybe you’re playing catch up from not saving before or maybe you don’t want to work 35 years before you can retire. Those are both appropriate reasons to increase your savings rate so that you have more choices as you get closer to retirement.

WHAT IF I DON’T HAVE A PENSION?

LET’S MAKE A PLAN!

Schedule a Meeting: In person or virtual

Jesse is a graduate of the University of Notre Dame and earned his Master’s in Education from Harvard. In his education career, he served as a teacher, counselor and Director of Alumni for YES Prep Public Schools. He is a member of the Teacher Retirement System of Texas (TRS) and takes pride in helping fellow educators better understand their pension and plan for their future. Learn more about Jesse.