We all grow a little wiser each year. In a recent post, I wrote about how I learned some of my greatest lessons in life from my childhood experiences. Good or bad, experience teaches us — think about the first time you burned your hand on the stove. Or maybe you saw someone else burn themselves. You likely didn’t get burned again.

Experience is the best teacher.

In 2010, I was in my 3rd year as an educator and was serving in the role of College Counselor. Although I was already interested in personal finance, I didn’t know much about the Teacher Retirement System of Texas (TRS). All I knew was that I was a member and that I had a growing balance in my TRS account each year. This story, however, isn’t about me. It is about my dad (pictured) and how I wish I knew more at the time to help him make an informed decision about his own TRS account. I have requested my dad’s permission to share part of his story with you.

After several years working for the county, my dad started working for the school districts in El Paso in 1999. He’s served a few different districts as a Security Officer. Each of those school employers were part of the TRS system. After 11 years, he left his role and withdrew the funds that had accumulated in his TRS account. Although he had some options available to him when it came to his funds, he was either unaware and didn’t seek help or made the decision he did, despite the implications. Here were his options:

- Leave contributions in TRS account and as a member, eventually be eligible for a TRS pension.

- Terminate his TRS membership and roll his retirement savings into another qualified retirement account.

- Terminate his TRS membership and receive a refund of his contributions.Hindsight is 20/20.

Hindsight is 20/20.

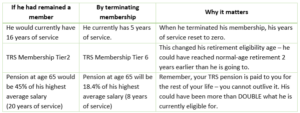

As you may have guessed, he decided to receive a refund of his contributions, terminating his membership in TRS. I know he did pay off some outstanding debt, including the note on his truck, however what he passed up is valued much greater. Here’s what I mean:

Remember, your TRS pension is paid to you for the rest of your life – you cannot outlive it. His could have been more than DOUBLE what he is currently eligible for.

It is unfortunate that many of us are not familiar with TRS and how it works – myself included! When my dad left his job at the district in 2010, I didn’t know much about TRS. Let’s be honest, even after 7 years of serving as an educator, I still didn’t know much about it. If he would have been a little more informed, maybe we would have made a different decision. As a financial advisor who serves many educators, I now know much of what I wish I would have. I could have at least reviewed my dad’s options with him. Hindsight is 20/20.

THERE’S GOOD NEWS: YOU CAN BUY YOUR YEARS OF SERVICE BACK!

Did you know that? My dad is eligible to purchase his years of service back if he wanted to. Everyone’s situation is different, but you can see why it would make sense for my dad to retire with more years of service and therefore a higher pension. Whether or not it is realistic for him to purchase those years of service back is another question.

ARE YOU A MEMBER OF TRS? I AM!

As you may know by now, I am also a TRS member with 7 years of service credit. Given what I’ve learned, my intention is to remain a member and eventually be eligible for a TRS pension. In my eyes, TRS is a great system — there are not many left like it anymore and I’m honored to be a member. In retirement, I expect to get more money back from TRS than I ever put into it. That is because TRS is what is called a defined benefit plan. Upon retirement, qualified retirees will receive a check for the rest of their life — you cannot outlive it!

If you’re a TRS member and you have questions about your pension, let’s set up a time to speak. I do not pretend to have all the answers but I will help you find them.

Schedule a time for you and I to speak more about your personal finances. We can do so online, over the phone or in-person.

Neither Lincoln Investment, Capital Analysts, nor any of their representatives are affiliated with the Teacher’s Retirement System of Texas (TRS); and TRS does not sponsor, authorize or endorse the retirement educational services described in this or other communications of them.